US Stocks Dip 1%, China Index V-Rebounds, Treasury Yields Hit 4%, Oil Prices Surge

The only major Wall Street bank, Citigroup, which still expected a 50 basis point rate cut in November, has also surrendered. The market has reduced its expectations for Federal Reserve rate cuts to less than 50 basis points by the end of the year for the first time since August 1st, with an estimated 21 basis points likely to be cut in November.

Investors are accelerating the sale of US stocks, with a general decline across all sectors, except for the energy sector, which closed higher due to the surge in oil prices. Advanced Micro Devices (AMD) saw its stock price soar by nearly 16% after announcing that it will ship 100,000 GPUs per quarter. Investors are concerned about Tesla's Robotaxi launch, the prospects of Apple's AI phones, and Google being banned from the app store, leading to a general decline in the seven tech giants, with Chinese concept stocks rebounding in a V-shape, falling nearly 3% before closing higher, outperforming the broader US stock market.

For the first time since August, the yields on two-year and 10-year US Treasuries once stood at 4%, with gold prices falling for three consecutive days. The US dollar hovered at a seven-week high, and the decline in US stocks boosted the performance of safe-haven currencies, the Swiss franc and the yen, with additional support for the yen from Japanese foreign exchange officials warning against speculating on the recent depreciation of the yen. Due to market concerns about Israel attacking Iran's oil infrastructure, coupled with Hurricane "Milton" upgrading to a Category 5 hurricane, oil prices have risen for the fifth consecutive day, with Brent crude closing above $80 for the first time since August.

Advertisement

In Europe, both the European Central Bank's Governing Council member Villeroy and the Governor of the Banque de France indicated that a rate cut is highly likely in October. However, the most hawkish member of the European Central Bank, Holzmann, stated that the European Central Bank must not prematurely declare victory over inflation, as core inflation in the eurozone remains too high.

The three major US stock indices all fell by about 1%, with investors accelerating the sale of US stocks at the end of the day,刷新ing daily lows, with the Nasdaq Composite falling by more than 1.3%, the S&P 500 by more than 1.1%, and the Dow Jones by more than 1.2%, with small-cap indices falling by more than 1.4%. Among the sectors, only the energy sector closed higher due to the surge in oil prices:

US stock indices all fell. The S&P 500 index closed down 55.13 points, a decline of 0.96%, at 5,695.94 points. The Dow Jones, closely related to the economic cycle, closed down 398.51 points, a decline of 0.94%, at 41,954.24 points. The technology-heavy Nasdaq Composite closed down 213.95 points, a decline of 1.18%, at 17,923.90 points. The Nasdaq 100 closed down 1.17%. The NASDAQ Technology-Weighted Index (NDXTMC), which measures the performance of technology stocks in the Nasdaq 100, closed down 1.05%. The Russell 2000 small-cap index, more sensitive to the economic cycle, closed down 0.89%. The VIX volatility index closed up 17.86%, at 22.64.

US industry ETFs generally closed lower, with the energy sector ETF leading with a gain of more than 0.3%. The utility sector ETF closed down 2.3%, the consumer discretionary ETF and the internet stock index ETF fell by about 1.5%, the financial sector ETF and the biotechnology index ETF fell by at least 1.2%, the global technology stock index ETF fell by more than 0.9%, the technology sector ETF fell by about 0.7%, the semiconductor ETF closed up 0.16%, and the energy sector ETF rose by 0.35%.

The 11 sectors of the S&P 500 index generally fell. The utility sector closed down 2.32%, the telecommunications and consumer discretionary sectors fell by more than 1.9%, the financial sector fell by more than 1.2%, the real estate sector and the information technology/technology sector fell by about 0.7%, and the energy sector rose by 0.35%.

In terms of news, Bloomberg data shows that as of October 4th, nearly $6 billion flowed into US-listed emerging market and country-specific ETFs, a new high in more than a year. Among them, five major ETFs investing in Chinese stocks attracted about $4.9 billion, an unprecedented scale. During the National Day holiday, traders turned their attention to futures listed in Singapore and Hong Kong, with the number of open contracts for the FTSE China A50 index futures on the Singapore Exchange reaching a record high. Goldman Sachs pointed out that clients are most concerned about "whether they see funds flowing from India to China," and the answer is "undoubtedly, yes."

Among the "Tech Seven Sisters," only Nvidia rose. Nvidia closed up 2.24%, while Apple closed down 2.25%, with Jefferies downgrading its rating, stating that investors are too optimistic about AI phones. Reports indicate that Apple plans to release Apple Intelligence and iOS 18.1 on October 28, and Apple has not given up on Micro LED technology, with AR glasses equipped with Micro LED expected to enter mass production in 2026, competing with Meta Orion's AR glasses. Tesla closed down 3.7%, Microsoft closed down 1.57%. Google A closed down 2.44%, with a judge ruling that Google's app store must allow competitors' apps to be listed. Meta closed down 1.87%, Amazon closed down 3.06%, and Wells Fargo downgraded Amazon's rating from overweight to equal weight, with a target price of $183.Chip stocks experienced mixed movements. The Philadelphia Semiconductor Index closed down by 0.19%, while the industry ETF SOXX closed down by 0.27%. The NVIDIA double-long ETF ended up by 4.52%. TSMC's ADR closed up by 1.85%, Micron Technology closed up by 0.76%, Arm Holdings closed up by 0.56%, AMD closed up by 0.04%, whereas Intel closed down by 0.93%, Qualcomm closed down by 1.16%, Broadcom closed down by 0.88%, and KLA closed down by 0.73%.

AI concept stocks also saw varied performances. Super Micro Computer closed up by 15.79%, marking its best single-day performance since May 15th, as the company announced that its AI GPU shipments for the quarter exceeded 100,000 units. Serve Robotics closed up by 11.74%, BigBear.ai closed up by 1.99%, NVIDIA-backed AI voice company SoundHound AI closed up by 1.07%, and C3.ai closed up by 0.08%. On the other hand, Dell Technologies closed down by 1.1%, CrowdStrike closed down by 1.8%, BullFrog AI closed down by 3.35%, Snowflake closed down by 0.78%, Oracle closed down by 0.52%, and Palantir closed down by 2.8%.

Chinese concept stocks outperformed the broader U.S. stock market. The NASDAQ Golden Dragon China Index closed at 0.07%, the China Technology Index ETF (CQQQ) closed up by 6.43%, the China Internet Index ETF (KWEB) closed up by 1.2%, the FTSE China 3x Long ETF (YINN) closed up by 13%, the FTSE China 3x Short ETF (YANG) closed down by 13.41%, the "China Dragon" ETF RONDHL CHINA ETF (DRAG) closed up by 3.12%, the Xtrackers Harvest CSI 50 (ASHS) closed up by 9.99%, and the Deutsche Bank Harvest CSI 300 Index ETF (ASHR) closed up by 7.98%. The FTSE A50 night session closed up by 1.98%, reaching a new high since mid-December 2021.

Among popular Chinese concept stocks, Mengniu Dairy's ADR closed up by 10.52%, Meituan's ADR closed up by 4.51%, Li Auto closed up by 4.18%, Ji氪 closed up by 4.01%, Baidu closed up by 3.63%, Alibaba closed up by 2.61%, Tencent Holdings' ADR closed up by 2.6%, XPeng Motors closed up by 2.11%, NIO closed up by 0.3%, JD.com closed up by 0.23%, while Tiger Brokers closed down by 7.51% after an initial surge of nearly 16.9%, Fangdd closed down by 14.23%, Bilibili closed down by 4.03%, NetEase closed down by 2.72%, New Oriental closed down by 1.29%, and Pinduoduo closed down by 0.76%.

Other key stocks: Activist investor Starboard Value holds approximately $1 billion in Pfizer shares, and Pfizer closed up by 2.17%.

European stocks continued to rise on Monday, ending a four-day losing streak:

The EURO STOXX 600 Index closed up by 0.18%, at 519.48 points. The EURO STOXX 50 Index closed up by 0.30%. Among sectors, home goods stocks led with a 0.97% gain, while technology stocks closed down by 0.65%.

The German DAX 30 Index closed down by 0.09%. The French CAC 40 Index closed up by 0.46%. The Italian FTSE MIB Index closed up by 0.66%. The British FTSE 100 Index closed up by 0.28%. The Dutch AEX Index closed up by 0.11%. The Spanish IBEX 35 Index closed up by 0.5%.

Strong non-farm employment, coupled with rising oil prices, has led investors to worry about the risk of a rebound in U.S. inflation. The market has downgraded expectations for rate cuts from central banks in the U.S., Europe, and the UK. The U.S. 2-year and 10-year Treasury yields both rose above 4% during the session for the first time since August, with European bond prices following U.S. bonds lower:

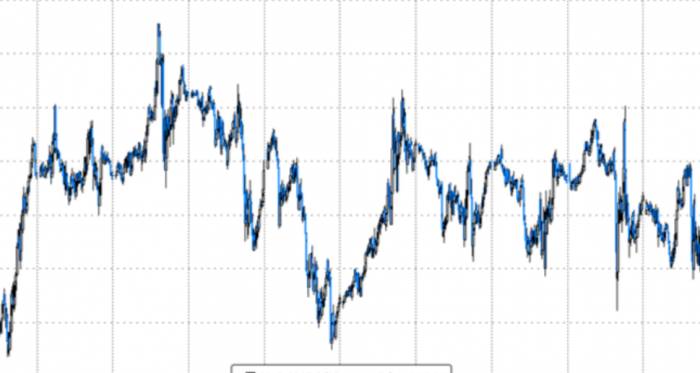

U.S. Treasuries: At the close, the more policy-sensitive 2-year U.S. Treasury yield rose by 7.76 basis points to 3.9994%, having risen more than 10 basis points to 4.0223% at one point during the session, for a cumulative increase of 39.71 basis points in the last four trading days. The U.S. 10-year benchmark Treasury yield rose by 5.64 basis points to 4.0236%, trading in the range of 3.9653%-4.0314%, approaching the August 1st peak of 4.0642%, and having risen to 4.7351% on April 25th.European Debt: At the end of the day, the benchmark 10-year German bund yield in the eurozone rose by 4.6 basis points to 2.256%. The two-year German bund yield increased by 4.4 basis points to 2.247%. The 10-year UK gilt yield rose by 7.8 basis points, and the two-year UK gilt yield increased by 8.4 basis points. The French 10-year government bond yield increased by 4.0 basis points, and the Italian 10-year government bond yield rose by 6.3 basis points.

The 2-year and 10-year US Treasury yields both broke through 4%.

The US dollar hovered at the seven-week high it reached on the non-farm payroll day. Most non-US currencies fell, with the British pound falling for seven consecutive days. However, safe-haven currencies such as the Japanese yen performed well, strengthening at one point to break through 148. The offshore renminbi strengthened, closing up 272 points, and Bitcoin rose by more than 0.8% to probe $65,000:

US Dollar: The US Dollar Index (DXY) fell by 0.03%, reporting 102.493 points, with intraday trading ranging from 102.620 to 102.368 points, detaching from the highest level of 102.687 points since August 16, reached on the non-farm payroll day (October 4). The Bloomberg Dollar Index rose by 0.03%, reporting 1238.67 points, with intraday trading ranging from 1236.91 to 1239.25 points.

Most non-US currencies fell: The euro was roughly flat against the US dollar, the British pound fell by 0.31% against the US dollar, and the US dollar fell by 0.46% against the Swiss franc; among commodity currency pairs, the Australian dollar fell by 0.70% against the US dollar, the New Zealand dollar fell by 0.58% against the US dollar, and the US dollar rose by 0.39% against the Canadian dollar.

Japanese Yen: The Japanese yen rose by 0.35% against the US dollar, reporting 148.17 yen, with intraday trading ranging from 149.13 to 147.86 yen.

Offshore Renminbi (CNH): The offshore renminbi rose by 272 points against the US dollar at the end of the day, reporting 7.0712 yuan, with overall intraday trading ranging from 7.1010 to 7.0581 yuan. The Chicago Mercantile Exchange (CME) reported that the trading volume of offshore renminbi futures on its platform soared to a record high, with strong demand for both spot and futures renminbi products throughout the year.

Cryptocurrencies: The largest market capitalization leader, Bitcoin, rose by 0.82% at the end of the day to stand above $63,000, with intraday trading ranging from $62,615.00 to $64,770.00. The second-largest, Ethereum, rose by 0.51% at the end of the day, reporting $2,445.50.

The market continues to worry about Israel attacking Iran's oil infrastructure, coupled with concerns about Hurricane "Milton" affecting refineries in the US Gulf of Mexico, oil prices have risen for five consecutive days, with US oil closing up 3.7% to the highest in six weeks, and Brent oil rising to $80 for the first time since August:

US Oil: WTI November crude oil futures closed up $2.76, a 3.71% increase, reporting $77.14 per barrel, with a cumulative increase of 18.42% since closing on September 10. US oil prices rose steadily throughout the day, with the highest increase of nearly 4.1% at the end of the day, standing above $77.40.Brent crude: Brent's December crude oil futures closed up $2.88, a gain of 3.69%, at $80.93 a barrel, marking the first time since August 12 that it closed above the psychological round figure of $80, with a cumulative rebound of 17.58% since the close on September 10. Brent crude prices rose steadily throughout the trading day, with the highest increase of nearly 4% breaking through $81.10 at the end of the session.

Analyst views: Alan Gelder, Vice President of Oil Markets at Wood Mackenzie, stated on Monday that the market currently only anticipates a possible Israeli attack on Iranian oil facilities, but the real threat is the potential disruption of shipping in the Strait of Hormuz, which accounts for 20% of the world's crude oil exports. If Iran retaliates against the strait due to an Israeli attack, this would severely impact global crude oil prices. Analysts warned that the current tensions in the Middle East have not yet led to disruptions in crude oil supplies, but the longer the conflict lasts, the greater the risk. Goldman Sachs pointed out that if Iranian crude oil supplies are disrupted, Brent crude could soar into the $90 range, with the increase depending on whether OPEC can make up for the supply gap.

In terms of news, Hurricane "Milton" rapidly intensified to wind speeds of 175 miles per hour, prompting President Biden to declare a state of emergency in Florida.

Natural gas: U.S. November natural gas futures closed down 3.78%, at $2.7460 per million British thermal units. The European benchmark TTF Dutch natural gas futures closed down 0.18%, at €40.925 per megawatt-hour. ICE UK natural gas futures closed up 0.40%, at 103.010 pence per thousand calories.

U.S. oil breaks through $77 for the first time since mid-August

Solid employment eliminates expectations for a significant rate cut by the Federal Reserve in November, with gold prices under pressure for three consecutive days:

Gold: COMEX December gold futures closed down 0.20% at $2,662.50 per ounce. Spot gold continued its earlier upward trend during European stock trading, rising by more than 0.2% to challenge $2,660, then continued to decline, falling nearly 0.6% to break through $2,640 before the U.S. stock market opened, and closed down 0.41%, at $2,642.74 per ounce, bidding farewell to the historical high of $2,685.42 set on September 26.

Silver: COMEX December silver futures closed down 1.39%, at $31.945 per ounce. Spot silver rose slightly at the beginning of the Asian market, but then continued to decline, falling by more than 2.4% to challenge $31.40 before the U.S. stock market opened. It closed down 1.67%, at $31.6850 per ounce.

In terms of news: The People's Bank of China has suspended gold purchases for the fifth consecutive month. Peter A. Grant, Vice President and Senior Metal Strategist at Zaner Metals, said that although the strong dollar has hindered gold prices from reaching new highs in the short term, gold still has the potential to reach $2,700 in the short term and even $3,000 in the long term, especially with the U.S. election approaching and geopolitical tensions increasing.

London industrial metals were mixed: The economic barometer "Dr. Copper" closed down 0.14%, at $9,930 per ton. LME lead closed down $1, at $2,148 per ton. Meanwhile, LME zinc closed up $8, at $3,174 per ton. LME aluminum closed up $5, at $2,658 per ton. LME tin closed up $100, at $33,905 per ton. LME nickel closed up 0.33%, at $18,052 per ton.COMEX copper futures fell by 0.43%, trading at $4.5545 per pound.

Gold experienced narrow fluctuations on Monday, with a slight decline.

Below is the content updated before 23:00 on October 7th.

On Monday, October 7th, during the early U.S. stock market session, all three major indices declined. The technology-heavy Nasdaq Composite, which includes many tech stocks, fell nearly 0.7% at one point. The Dow Jones Industrial Average, closely related to the economic cycle, fell more than 0.5% or 218 points at one point, and the S&P 500 index fell more than 0.4% at one point.

Chinese concept stocks took a temporary breather. The NASDAQ Golden Dragon China Index initially rose by more than 1.6% but then fell by more than 2.8%. Component stocks such as Agora and Beike currently fell by more than 8%. Jikrypton once rose by more than 21.4% but then halved its gains. Li Auto rose by more than 5.8% and then fell back. Xiaopeng Motors initially rose by more than 5.9%, NIO initially rose by more than 2.1% and then fell by more than 1.4%. Mengniu Dairy's ADR once rose by more than 5.9%, while Fangdd fell by more than 33.2%, and Bilibili fell by more than 5.9% but then narrowed its losses.

The tech "Seven Sisters" saw more declines than gains. Amazon fell by more than 3.1% at one point, and Tesla fell by more than 2% at one point. Apple fell by more than 1.2% at one point, with Jefferies downgrading its rating, stating that investors are too optimistic about AI phones. Google A fell by more than 0.6% at one point, Microsoft fell by more than 0.4% at one point, and Nvidia rose by more than 2.3% but then halved its gains.

Semiconductor stocks saw more declines than gains. The Philadelphia Semiconductor Index fell by more than 0.7% at the start, ASML's ADR fell by more than 2.6% at the start, while TSMC fell by nearly 1.9% at the start and then gave up most of its gains.

AI concept stocks fluctuated. Serve Robotics once rose by nearly 21%, Super Micro Computer once rose by more than 6.2%, BigBear.ai once rose by more than 6.5%, while BullFrog AI once fell by more than 2.5%, Dell Technologies rose by more than 0.2% and then fell by more than 1%. Oracle once rose by nearly 0.5%.

In terms of investment research strategy, Liu Jingjin from Goldman Sachs published the latest comments, listing the top ten reasons to buy Chinese assets currently. For example, first, the "policy bottom" has emerged, with policies supporting economic growth and the stock market. Citigroup changed its forecast for the Federal Reserve, expecting a rate cut of 25 basis points in November instead of 50 basis points.

The following is an article by Wall Street Journal before the U.S. stock market opens.Last week, the unexpectedly strong non-farm employment data for September released by the United States led to a decline in the U.S. stock market, with a rebound in the yields of major Treasury bonds. The market is now awaiting the U.S. inflation data to be announced this Thursday, with economists expecting a slight slowdown in year-over-year price growth.

On Monday, October 7th, before the U.S. stock market opened, the yield on the 10-year U.S. Treasury bond rose by more than 4%, and the yield on the 2-year U.S. Treasury bond broke through 4% for the first time since August, continuing the upward trend from Friday.

The three major U.S. stock index futures collectively declined, the European Stoxx 600 index slightly fell, and European bond yields collectively rose.

At present, the swap market has set the expectation for a rate cut in the United States next month at less than 25 basis points, while until recently, the market was expecting a rate cut of 50 basis points.

In addition, the earnings season for U.S. banks is about to begin. Although some analyses expect profit growth to slow down from the second quarter, the data is still expected to be strong.

Today, Asian stock markets generally closed higher, with the Nikkei 225 index closing up by more than 2%, and the South Korean KOSPI index closing up by 1.58%. Only the Indian stock market closed lower, with the NIFTY index closing down by 0.87%, and the SENSEX index closing down by 0.78%.

The latest data shows that the net selling scale of global funds for Indian stocks has reached a record high, with the Indian stock market experiencing the largest net selling by global funds since at least January 1, 1999. Goldman Sachs believes that this is because "when the Chinese stock market sees 'intense' buying, the Indian market becomes vulnerable."

Goldman Sachs India trader Nikhilesh Kasi stated in response to clients, "Undoubtedly, yes, (funds are flowing from India to China)," and explained that this trend is very clear based on the fund flows they have observed.

In terms of oil prices, due to the rapid deterioration of the situation in the Middle East, crude oil prices soared last week. On Friday, Brent crude oil futures rose by more than 5%. Currently, Brent crude oil is approaching $80 per barrel. Goldman Sachs also said in another report that oil prices are experiencing a short squeeze.

Goldman Sachs stated that with the upward momentum in the energy industry being ignited, the historic oil market short squeeze has only just begun. If Israel really takes action to destroy Iran's oil infrastructure, or worse, targets its nuclear industry, the impending surge in oil prices will make the Volkswagen short squeeze of 2008 pale in comparison.

post your comment