Hong Kong Stocks Soar in October; Hang Seng Tech Index Jumps 10%

Hedge funds and mutual funds are vying to purchase Chinese assets. The Hang Seng Index and its volatility index have both climbed for six consecutive trading days, the last time this occurred, the Hang Seng Index continued to soar by 30% over approximately two months.

After closing on Tuesday for a holiday, Hong Kong stocks opened higher on Wednesday, continuing the rally sparked by China's stimulus measures.

The Hang Seng Tech Index surged by 10%, reaching a new high since February 2022. The Hang Seng Index rose by over 7%. Among the major constituents of the Hang Seng Tech Index, Dongfang Zhenxuan rose by more than 28%, Bilibili by more than 21%, Alibaba Health and Meituan by more than 15%, Li Auto by more than 13%, and JD.com and Baidu by more than 12%.

Chinese brokerage stocks listed in Hong Kong continued to surge, with Shenwan Hongyuan Hong Kong rising by over 90%, Xingye International and China Merchants Securities by over 30%, and Guotai Junan International and CITIC Securities by over 20%.

Following the authorities' announcement of a series of stimulus measures last week (including interest rate cuts, cash releases to banks, and liquidity support for stocks), the sustained rebound indicates investors' ongoing optimism about China's economy and risk assets. Home purchase restrictions have also been eased in four major cities, and the central bank has begun to lower mortgage loan interest rates.

Advertisement

Billy Leung, an investment strategist at Global X Management in Sydney, said that the surge "reflects a fundamental shift in investor positioning, with hedge funds and mutual funds that were previously underexposed now turning to Chinese assets."

A sign of heightened investor interest is that hedge funds are pouring into the Chinese stock market at a record pace. Mount Lucas Management, based in the United States, has begun to bullish on Chinese exchange-traded funds (ETFs), while GAO Capital in Singapore and Timefolio Asset Management in South Korea are buying large-cap Chinese stocks. Tribeca Investment Partners in Sydney is scooping up agents such as Australian miners.

Xin-Yao Ng, Director of Investments at abrdn Asia Ltd., said, "To fully restore market confidence, there are many issues we need to consider—consumption, real estate, local government financing platform debt. If the government is really determined to 'do whatever it takes,' it indeed requires a tremendous effort. The market has shown that investors are beginning to believe their words. Now it's time to prove the effectiveness."

Greater Upside Potential

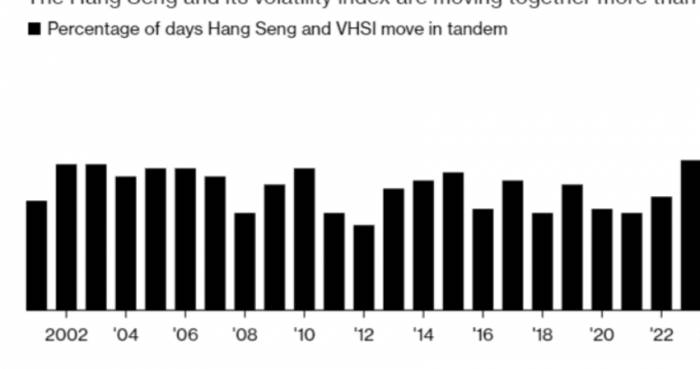

It is noteworthy that the Hong Kong benchmark stock index and an indicator tracking option costs have moved in the same direction for six consecutive trading days. The last time this happened, the Hang Seng Index continued to surge by 30% over approximately two months.Only time can prove whether the Chinese and Hong Kong markets will continue to climb further, but for now, the sentiment of a bull market has definitely emerged. The Hang Seng Index soared by 16% over the five trading days ending on Monday, marking the largest increase in over two years. Last Friday, the CSI 300 Index achieved its best single-day gain since 2008, entering a bull market.

With the introduction of China's economic stimulus plan, the fortunes of stock market bulls may finally begin to turn. The frenzy in the stock market has permeated the options market, with investors chasing the rally and driving up the prices of short-term contracts.

Gary Dugan, CEO of Singapore's Global CIO Office, said, "It's best not to vote against further rises in the Chinese stock market at the moment."

After both the Hang Seng Index and the Hang Seng Index Volatility Index fell on September 23, the two indices climbed in unison over the five days ending on Monday, both closing at highs. It has been a long time since both have risen in tandem, shortly after the Hang Seng Index touched a 13-year low in November 2022.

Volatility indices, such as the CBOE Volatility Index (VIX) in the United States, are often seen as panic indicators because they tend to rise with increased hedging demand when the stock market plummets. If the stock index and the volatility index fluctuate together, this could be a warning signal.

However, Jason Lui, Head of Asia-Pacific Equity and Derivatives Strategy at BNP Paribas, said that the situation in Asian markets is different.

Lui said: "Investors tend to chase upside risks by buying call options, leading to the 'spot rise, volatility rise' phenomenon. If the overall market sentiment is weak, volatility tends to be amplified, as is the case with the Hong Kong/Chinese market this time."

The correlation between the Hang Seng Index and its volatility index has reached a record level this year, with 49% of trading days showing consistent trends. In the United States, the S&P 500 Index and the VIX Index have historically shown similar fluctuations 21% of the time.

UBS Group estimates that there is more room for the Hang Seng Index to rise. The Swiss bank has raised its year-end target to 22,100 points, which is 4.6% higher than Monday's closing price.

Value Partners Group said that global funds that have reduced their exposure to China are ready to re-enter the market. Chen Jun Yu, the company's Deputy Chief Investment Officer for equities, said, "There should be a substantial amount of capital that needs to be allocated to stocks in Hong Kong and mainland China. We expect the Chinese stock market may experience a medium to long-term rebound."

post your comment